A shift in consumer demand, driven by tech-savvy next-generation borrowers who expect a seamless digital experience, means lenders must invest in digital lending solutions and tools to enhance the overall customer journey. In this evolving landscape, lending service providers are setting themselves apart through proprietary solutions, partnerships, acquisitions, and strategic investments.

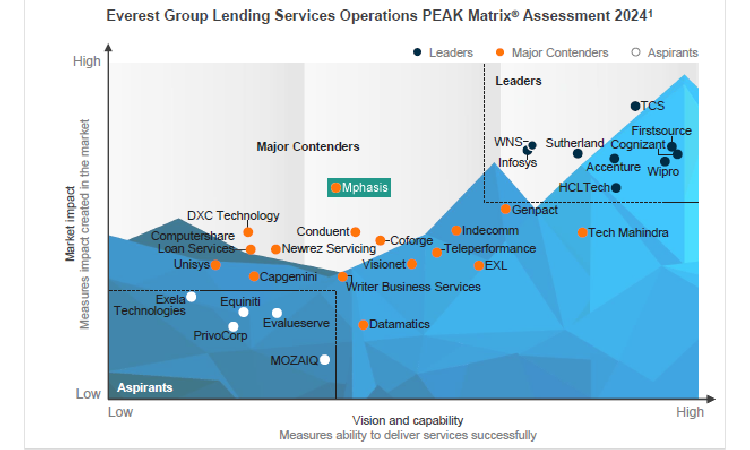

The Everest Group’s Lending Services Operations PEAK Matrix® Assessment 2024 evaluated 30 leading lending services providers and positioned Mphasis as a ‘Major Contender’ in the space. The report characterized Major Contenders as providers who are strategically investing in organic growth and acquisitions, diversifying their geographies and lines of business, offering a delivering footprint with a mix of onshore, nearshore, and offshore solutions, while also investing in proprietary platform solutions.

In the report, Everest highlights the following strengths of Mphasis in the lending services space:

● Acquisitions of Blink UX, a user experience research, strategy, and design firm, and Datalytyx, a DataOps specialist in the Snowflake and Talend ecosystems.

● Partnerships with Be Informed, a digital transformation platform for intelligent automation of knowledge work and complex decision making, Camunda, a global software company specializing in BPM (Business Process Management), and Upswot, a fintech firm.

● Optimize.AI – Mphasis’ process mining platform to identity transformation opportunities.

● Mphasis operates across the mortgage processing space, it has a history of services across underwriting, closing, loan origination and mortgage securitization.

● Extensive operating history in loan originators and secularization programs. Approved by agencies such as DBRS, S&P, Moody’s and Fitch Ratings.

● Entered into multi-year contract with AWS to collaborate and launch Gen AI Foundry, with mortgage processing as one of the highlighted use cases.

● One of the largest providers in the origination market, operating through Mphasis Digital Risk.

● Mphasis’ Technology solutions and tools.

o SynthStudio: Generates high-quality synthetic data.

o AI Audit Framework: Systematically checks the robustness of the model to various cyber attacks.

o MIDAS: Onboarding form extraction and downstream onboarding automation.

o iVue: Open-source BPM workflow and reporting tool.

Learn more about Mphasis’ Mortgage Solutions.